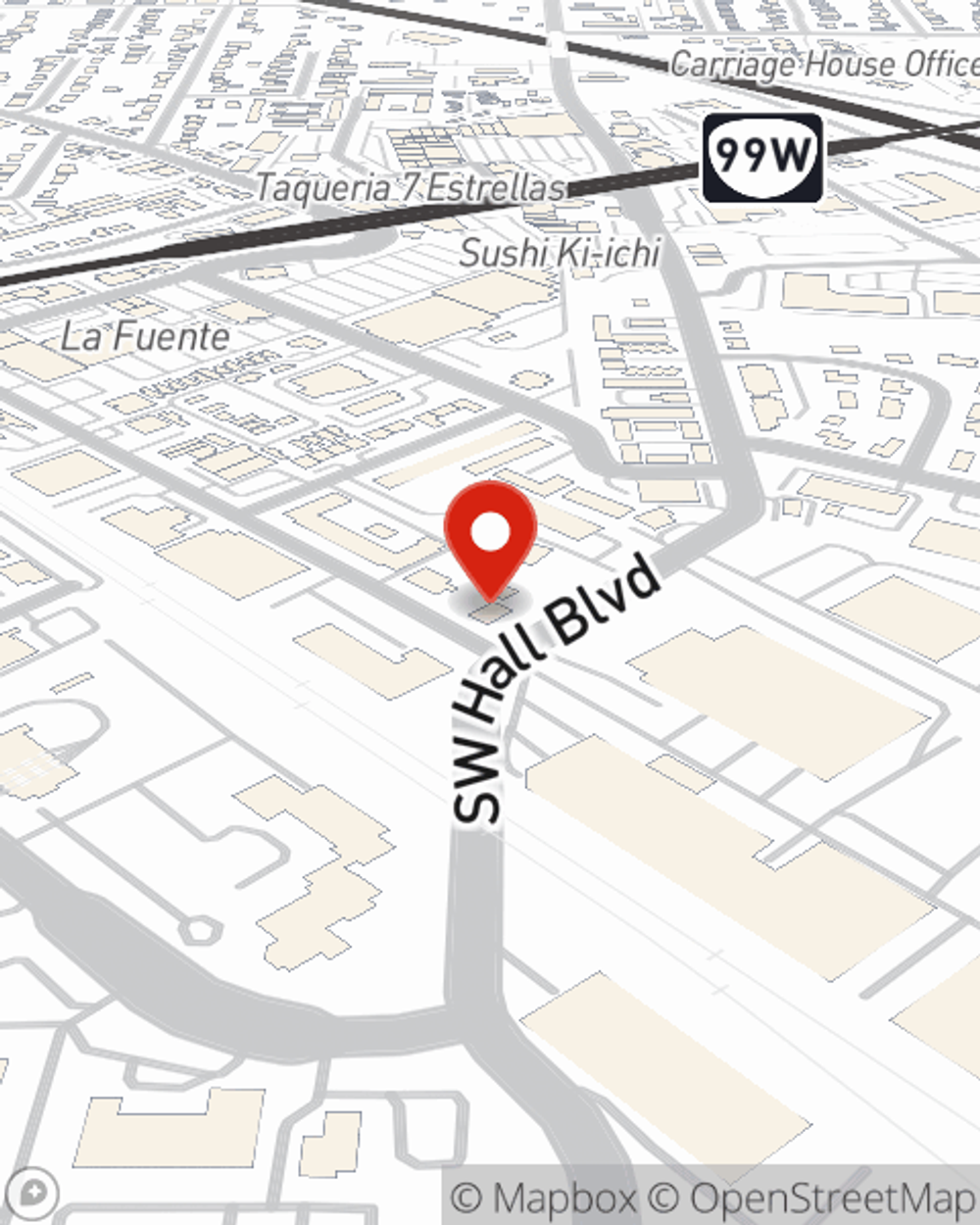

Business Insurance in and around Tigard

One of Tigard’s top choices for small business insurance.

Insure your business, intentionally

Insure The Business You've Built.

It's a lot of responsibility to start and run a business, but you don't have to figure it out all by yourself. As someone who also runs a business, State Farm agent Mark Creevey is not unaware of the work that it takes and would love to help lift some of the burden. This is coverage you'll definitely want to learn more about.

One of Tigard’s top choices for small business insurance.

Insure your business, intentionally

Protect Your Business With State Farm

That's because a small business policy from State Farm covers a wide range of concerns. Your coverage can include a business owners policy that provides for loss of income (for up to 12 months) in the event your business is temporarily closed. It not only protects your salary, but also helps with regular payroll overhead. You can also include liability, which is important coverage protecting your business in the event of a claim or judgment against you by a consumer.

Reach out to the excellent team at agent Mark Creevey's office to discover the options that may be right for you and your small business.

Simple Insights®

Farm scheduling versus blanket coverage

Farm scheduling versus blanket coverage

When deciding between blanket coverage or scheduling, we have some tips that could help with the decision.

Protect your business property from slip and falls

Protect your business property from slip and falls

Decrease the chances of slips, trips and falls at your business with proper maintenance and safety procedures.

Mark Creevey

State Farm® Insurance AgentSimple Insights®

Farm scheduling versus blanket coverage

Farm scheduling versus blanket coverage

When deciding between blanket coverage or scheduling, we have some tips that could help with the decision.

Protect your business property from slip and falls

Protect your business property from slip and falls

Decrease the chances of slips, trips and falls at your business with proper maintenance and safety procedures.